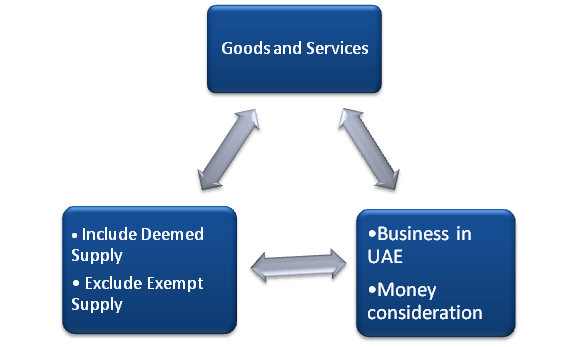

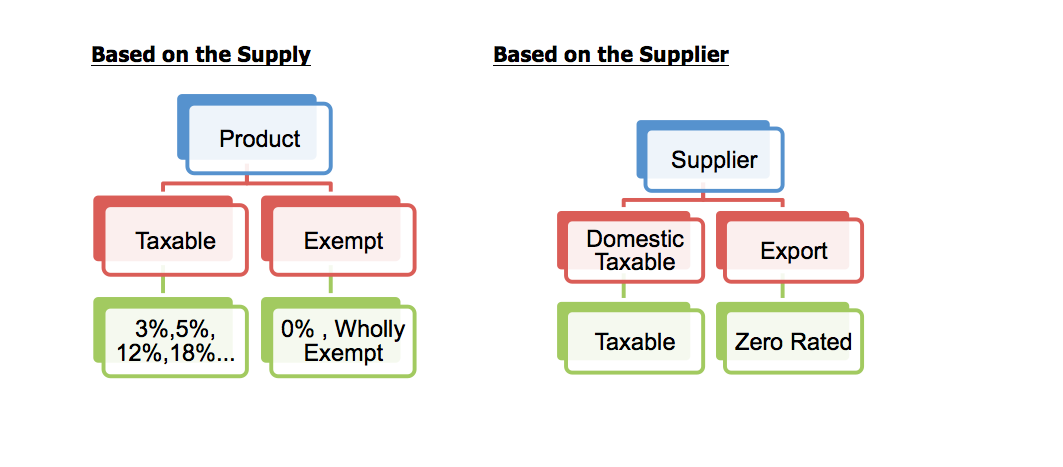

Nexdigm - With #Oman #VAT implementation on the horizon, the businesses must evaluate the compliance requirements. #DidYouKnow which supplies would be considered as deemed supply of goods under Oman VAT? Read through

Nexdigm on Twitter: "#DidYouKnow what will be covered as the supply of goods under the #Oman #VAT? Access further details here https://t.co/OVZjj5ZVNN #GCC #business https://t.co/FX5Kv0h4py" / Twitter